Contents

The rising number of complaints about deficiency in services against NBFC (non-banking finance company) has moved RBI (Reserve Bank of India) to establish a system of ombudsman similar to that of banks. The banking ombudsman has been operative for around 2 decades. By setting up this system, RBI enabled NBFC customers to lodge complaints. The complaints could be about levying extra charges without adequate prior notice, delays in sanction or disbursement, non-observance of RBI directives on the engagement of recovery agents, and/or non-observance of the prescribed time scheduled for disposal of loan applications. So let’s first understand what all services NBFCs are supposed to provide and what fields NBFCs are not entitled to operate in.

An NBFC, according to RBI, is a financial company registered under the Companies Act, 1956 or 2013, which should be engaged in the business of loans and advances, shares, stocks, bonds, debentures, securities which are issued by the government agencies or local authority, leasing, hire-purchase, insurance, or chit business. However, any company whose principal business is that of agriculture, industrial activity, purchase or sale of any goods, or related to selling, buying or building immovable property cannot become an NBFC. Apart from that, we can say that any non-banking company whose principal business of receiving deposits under the scheme or arrangement, in lump sum or instalments — or any other manner, will be called an NBFC.

RBI monitors the registration of NBFC. Its operations are regulated based on the directions issued by RBI. To get NBFC license, minimum NOF (net owned fund) of Rs. 2 Crore is required. Only after obtaining a CoR (certificate of registration) from RBI, it can commence its operations of non-banking financial activities.

The top NBFC in India are Power Finance Corporation Ltd, Shriram Transport Finance Company Ltd, Cholamandalam Investment & Finance Co. Ltd, Bajaj Finance Ltd, etc.

NBFC RBI Complaint Redressal

Different types of NBFC offer different types of services and products. For every NBFC, RBI has made it mandatory to have one grievance redressal officer. Moreover, the name and contact details of the officer must be displayed prominently on the premises of the NBFCs. A person can approach the grievance redressal officer of the NBFC to file a complaint. On the premises of NBFCs, details of the respective RBI offices are also to be mandatorily displayed. In case the client is not satisfied by the settlement offered by the grievance redressal officer then the nearest regional office of RBI can be approached.

NBFC Complaint Redressal by RBI

To improve customer experience in the NBFC sector, RBI launched an application on its website to lodge complaints against NBFC companies. The CMS (Complaint Management System) software application was introduced to facilitate the grievance redressal process against NBFCs. Customers can now raise any kind of issues against the NBFCs.

This online window was launched for customer complaints relating to banks, NBFCs, or System Participant/intermediary through an online CMS portal. The aim is to speed up the process of customer grievance redressal. This portal is accessible on desktop as well as mobile devices.

Customers are now able to file a complaint and track its status on this app or the website.

The complaints are directed to the appropriate office of the Ombudsman or regional office of the RBI. Appeals, against the decision of the Ombudsmen, if any, or if you are not satisfied with the action taken, can also be filed here.

Once the complaint is lodged, the customer receives an acknowledgment and a URN (unique registration number) via SMS or email notifications. The status can be tracked using this URN easily.

There is also the facility to give voluntary feedback on the experience to RBI.

The complaints received through CMS are accessed by the Principal Nodal Officers/Nodal Officers of respective NBFC. They can also use the information to analyse & eliminate the causes or take corrective measures and recognize the areas that need improvement.

In this way, the system has helped the entities to monitor and manage grievances as well.

CMS also makes it easier for concerned RBI officials to track the status of redressal. Various reports are generated to facilitate RBI to monitor and manage complaints that pertain to each entity. And this data is used by it for regulatory and supervisory interventions.

Clause 8 for Valid Complaints Against NBFC

Clause 8 of the Ombudsman Scheme for NBFC, 2018 by RBI explains the situations when the NBFC Ombudsman can receive and consider any complaint:

- Non-payment or excessive delay in the payment of interest on deposits.

- NBFC has not adhered to RBI directives applicable to rate of interest on deposits.

- Non-repayment or excessive delay in the repayment of deposits.

- Non-presentation or undue delay in the presentation of post-dated cheques (PDCs) given by the customer.

- The sanctioned amount of loan was not conveyed in writing, as also the terms and conditions including annualised rate of interest and method of application.

- The above information was not provided or was refused to be provided in the vernacular language or a language as understood by the borrower.

- Adequate notice, on proposed changes being made in sanctioned terms and conditions in vernacular language as understood by the borrower, was not provided or was refused to be provided.

- Once the borrower has repaid all dues, the NBFC failed to release or delayed releasing the securities/documents back.

- Some charges were levied without adequate prior notice to the borrower/customer.

- Failure to provide legally binding built-in repossession clause in the contract/loan agreement.

- Failure to ensure transparency in the contract/loan agreement about:

- notice period before taking possession of the collateral,

- circumstances under which the notice period can be waived,

- the procedure for taking possession of the security,

- provision of final chance for the borrower for repaying the loan before the sale/ auction of the security,

- the procedure of returning the collateral to the borrower, and

- the procedure for sale/ auction of this security.

- Any directives of RBI, as issued from time to time, were not adhered to.

Complaints Not Considered Valid by NBFC RBI

The complaints will not be considered valid under the following circumstances:

- If the NBFC registration has not been done under RBI.

- If the NBFC was not approached with the complaint, at first.

- The complaint is not covered by the grounds of complaint specified in the above topic, under Clause 8 of the Scheme.

- The complaint was not appealed within 1-year from the date of receipt of a reply from the NBFC. And if no reply is received, and the complaint to NBFC Ombudsman is made after more than 1-year and 1-month from the date of complaint to the NBFC.

- If the subject matter of the complaint is sub-judice or has already been dealt with by some other forum like the court of law, consumer court, etc.

- If the complaint is for the same subject matter that was settled, in an earlier proceeding, through the office of the NBFC Ombudsman.

- The basis of the complaint is frivolous or vexatious.

Steps to Complaint Against NBFC With RBI

To begin with, you must be ready with complete details of the entity you are lodging a complaint against. Its name, address, district it belongs to and so on. Most of the fields to be filled have a pre-defined drop-down list from where you will have to select the required option, removing confusion about these fields.

Here’s a brief guide on how you can file a grievance on the CMS system:

Step 1

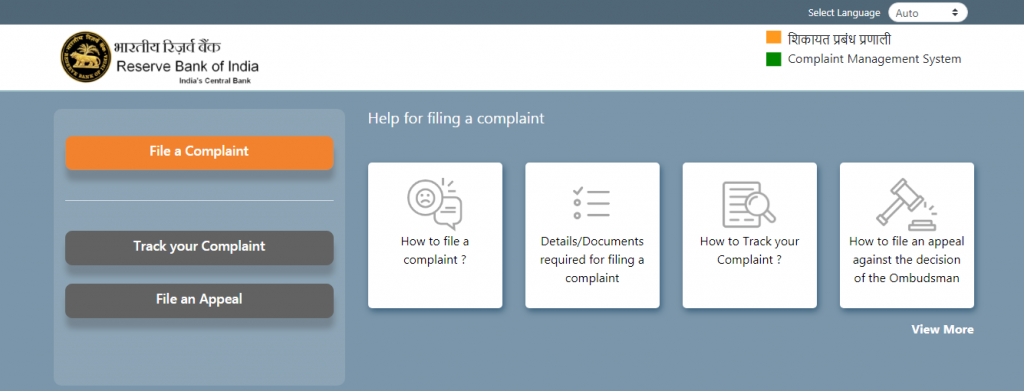

Visit https://cms.rbi.org.in. There is a drop-down list on the upper right corner to select your preferred language from English or Hindi. Click on the “file a complaint” tab.

CMS Site Home Page

Step 2

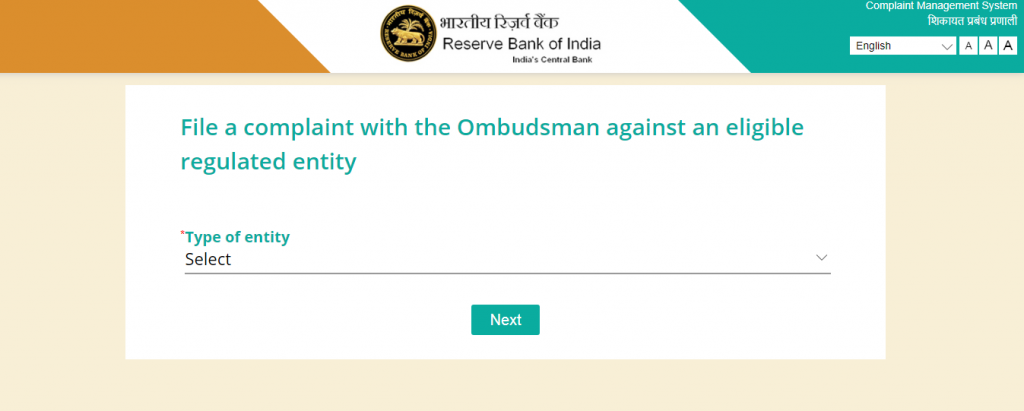

Now, come to “File a Complaint with Ombudsman against an eligible regulated entity”. From the dropdown list here, select the entity you are complaining against. A Bank, NBFC or system participant (the party or intermediary participating in a funds transfer system or settlement system).

Select the NBFC to complain against

Step 3

The page will expand for you to enter your mobile number, name & e-mail-ID and details of the NBFC.

Complainant’s Details

Step 4

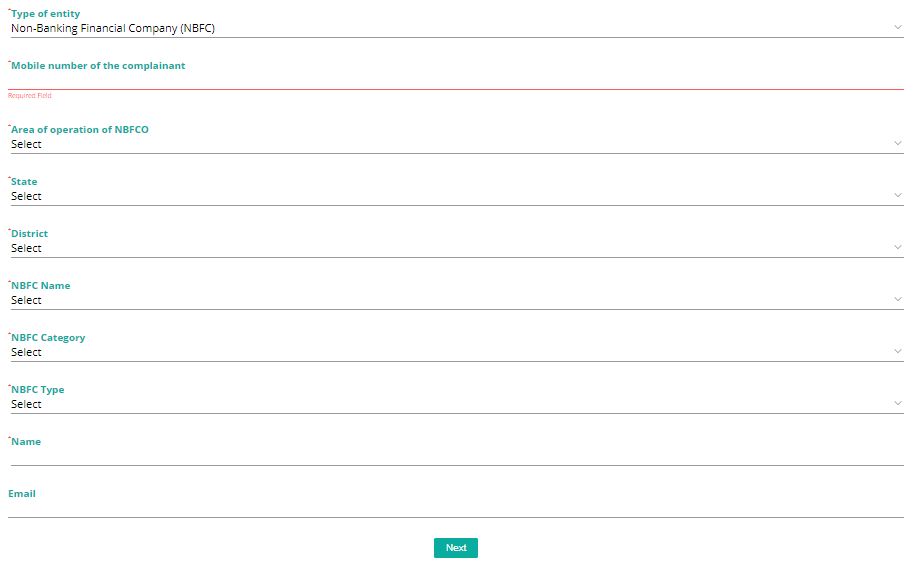

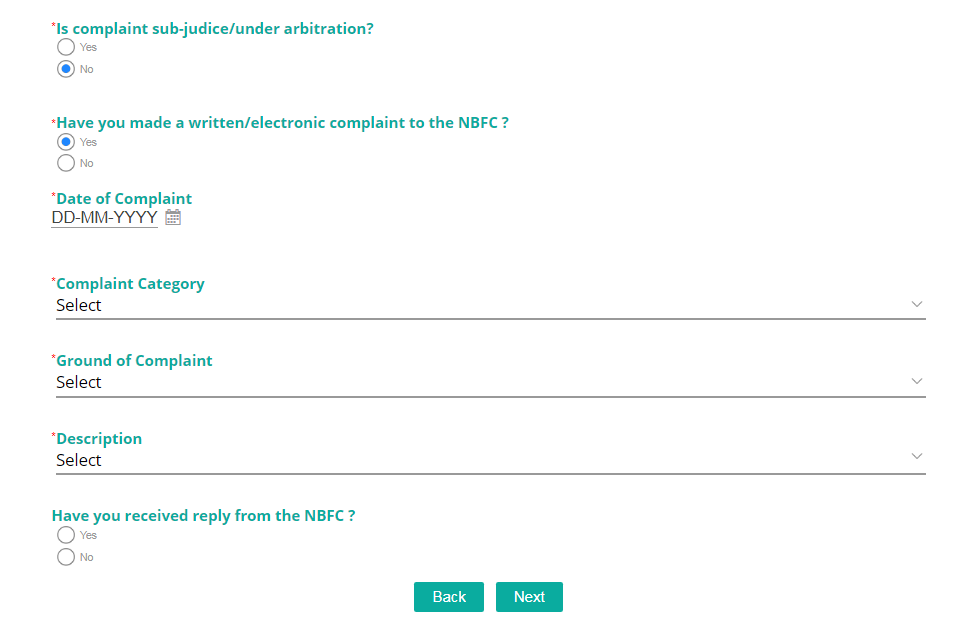

Next comes the page asking whether the complaint is under judicial arbitration or not. Once you have selected, you will be asked whether a complaint (written or electronic) has been lodged already with the entity.

Details about Status of Complaint

Step 5

Now the fresh page asks you about your address, gender, etc. And then you have to fill the nature, amount, compensation sought, and other facts of the complaint.

Fill in the Complaint Details

Step 6

Read thoroughly and fill.

Step 7

Next comes the declaration. Go through the conditions and click ok.

Step 8

Don’t forget to fill in the Nomination details. Especially if compensation is being sought.

Step 9

Now comes the page where you can upload the documents, if any, supporting your claim.

Step 10

Click on the Submit button to file your complaint successfully.

You will be informed through auto-generated acknowledgments, so you can track the status and file further appeals online against the decisions of the Ombudsmen, as applicable. You can also download PDF file of this.

Credit Card Complaints

If your grievance concerns credit card operations of an NBFC, the process of filing complaints is somewhat different.

NBFCs, generally, offer credit cards in association with banks, especially if it is a group company of a bank.

Once you have filed a written complaint with the NBFC, it has to respond within 30-days. If you don’t get a satisfactory response, you have the option to approach the Office of the concerned Banking Ombudsman for its redressal.

NBFCLicenseIndia is the company with all-round expertise in matters related to NBFCs. From registration, NBFC Takeover, Buy NBFC or NBFC Sale India, we do it all. We also assist in activities about legal, compliances and maintaining accounts.

Get registered NOW or call us at +91 8750008585.

Related Articles:

NBFC Deposits, Reserve Funds, etc under RBI Act

Frequently Asked Questions

Q. How to complain against NBFC?

First and foremost the complaint has to be filed with the NBFC itself. RBI has made it mandatory for every NBFC to have a grievance redressal officer, whose name and contact details must be displayed prominently on the office premises of the NBFC. This officer should be approached to complain against the NBFC.

If no corrective measures are taken or the complainant is not satisfied by them, the level is to go to the NBFC ombudsman. This can be done by filing a written complaint on plain paper or the CMS application.

The party still aggrieved by the redressal or the decision of the Ombudsman can approach the Appellate Authority.

The Appellate Authority lies with a Deputy Governor-in-Charge of the department of RBI. The address of the Appellate Authority is:

The Appellate Authority

Ombudsman Scheme for NBFCs

Consumer Education and Protection Department

RBI

First Floor, Amar Building

Fort, Mumbai-400 001

Q. What is the time limit for filing an appeal?

- One has to appeal within 30 days of the date of receipt of the information on an award or rejection of the complaint. An appeal against the decision of the award or the decision of the NBFC Ombudsman rejecting the complaint. The Appellate Authority may, if he/ she is satisfied that the applicant is justified for not making an application for appeal within this time, also allow an extension of this period by not more than 30 days.

Q. What complaints can be filed against NBFCs?

Clause 8 of the Ombudsman Scheme for NBFC 2018 mentions the complaints that would be considered as valid as:

- non-payment or undue delay in the payment of interest on deposits,

- non-adherence to some of RBI directives concerning the applicable to rate of interest on deposits,

- non-repayment or excessive delay in the repayment of deposits,

- non-presentation or undue delay in presenting the post-dated cheques provided by the customer;

- failure to advise the amount of loan sanctioned, annualised rate of interest, and terms and conditions including and method of application thereof, in writing,

- failure or refusal to provide sanction letter/terms and conditions of sanction in the local language or a language as understood by the borrower,

- failure or refusal to provide adequate notice on proposed changes being made in sanctioned terms and conditions in vernacular language as understood by the borrower,

- failure or undue delay in releasing the collateral kept by the borrower, once all dues have been repaid,

- any charges being levied without notifying the customer,

- failure to provide legitimate built-in repossession clause in the contract/loan agreement,

- the contract/ loan agreement doesn’t mention below transparently:

(i) notice period before taking possession of the collateral/security.

(ii) circumstances under which the notice period can be waived.

(iii) procedure for taking possession of the security.

(iv) provision of final chance to be given to the borrower for repayment of the loan before recovering from the security.

(v) procedure of repossession to the borrower and

(vi) procedure for recovering from the security.

- non-observance of RBI directives,

- non-adherence to other provisions by RBI such as Fair Practices Code.

Q. When will one’s complaint not be considered by the Ombudsman?

A complaint will not be considered under the following circumstances :

- If the NBFC against whom the complaint is filed, is not covered under the Scheme.

- If the NBFC concerned, was not approached first for redressal of the grievance.

- If the subject matter of the complaint is not valid as specified under Clause 8 of the Scheme.

- If the time frame for filing a complaint has not been adhered to. The complaint not made within a year from the date of receipt of reply from the NBFC. If no reply is received, and the complaint to NBFC Ombudsman is made after more than a year, or within a month from the date of complaint to the NBFC.

- If the subject matter of the complaint is at any other forum like a court of law, consumer court, etc. Pending for disposal/has already been dealt with.

- If the complaint is for the same subject matter that was settled earlier through the office of the NBFC Ombudsman.

- If the complaint is frivolous or vexatious.

Q. Which are the NBFCs covered under the Ombudsman Scheme?

NBFCs, as defined in Section 45-I (f) of the RBI Act, 1934 and registered with RBI under Section 45-IA of this Act. And which have been authorised by RBI to accept deposits or have a customer interface, with assets size of Rs. 100 crore or more, as on the date of the audited balance sheet of the previous financial year, or of any such asset size as RBI may prescribe.

Q. Can a complaint be filed by a representative?

Yes. The complaint can be filed by a representative with authorization of the customer, but it can’t be his (or her) advocate.

Q. Can a complaint be rejected?

Yes. A complaint can be rejected at any stage because:

- the complaint has not been made within the grounds of complaint referred to in clause 8 of the Scheme; or

- the compensation sought is more than the limit specified under the Scheme; or

- elaborate documentary and oral evidence and the proceedings are required to support the complaint. Such that the office of the Ombudsman is not enabled to are not appropriate for adjudication of such complaint; or

- it has been made without a sufficient cause; or

- complainant doesn’t pursue it with reasonable diligence; or

- there is no loss or damage or inconvenience caused to the complainant, as per the Ombudsman.

Q. What if the complaint is not settled by agreement?

The NBFC Ombudsman passes an Award if the complaint is not settled by an agreement within a specified period. First, the complainant and the NBFC will be given a reasonable opportunity to present their case. The complainant has the option to accept the Award in full and final settlement or reject it.